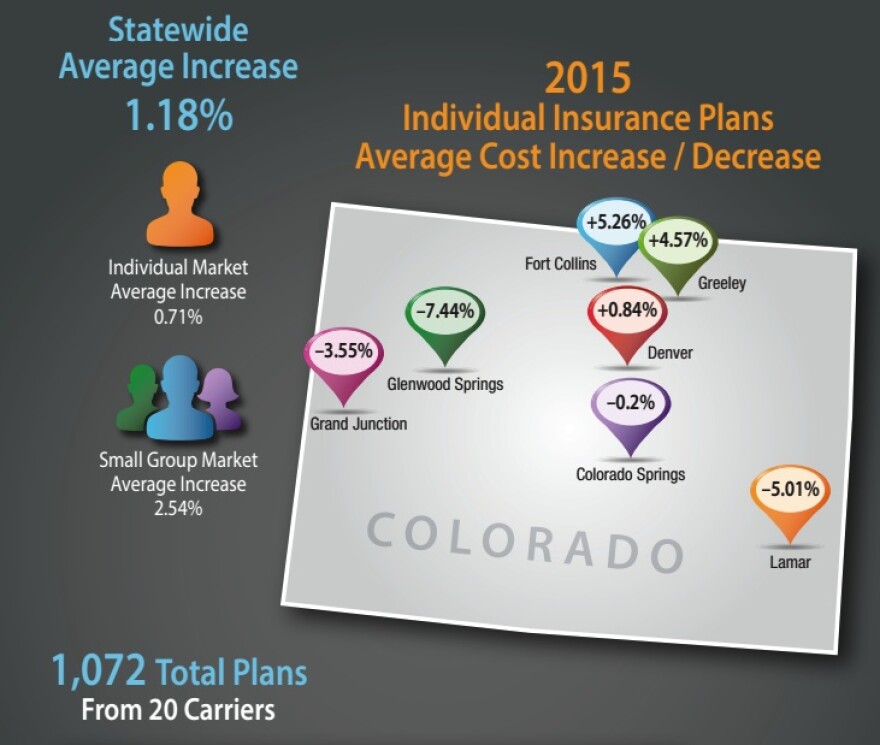

Health insurance in the Glenwood Springs area will go down by nearly ten percent next year. That’s on average, and it’s compared to an overall average increase of about one percent across Colorado. State officials gave final approval for the lower rates this week. This comes after concerns about especially high insurance in the Roaring Fork Valley, and an earlier flawed attempt to let consumers review rates beforehand.

The news signals a big change since insurance rates have been going up by about ten percent in recent years. Vince Plymell is with the Colorado Division of Insurance, which this week gave insurance companies the green light on lowered premiums.

“We’re happy to see that. But we’re going to encourage people, theses are averages, they represent higher and lower numbers, and people should always take look at the particulars for the plans they are considering. For their age, for their area.”

Click here for a quick chart for on average rates (HMO Colorado and Rocky Mountain Hospital both stand for the insurance carrier Anthem.) But here's how to find exact rates: for people who bought health insurancethrough Connect for Health, the statewide exchange, rates will be available on the exchange website. For others, it’s best to contact an insurance carrier directly to find out how much a premium will be next year. The rates don't include a tax credit some residents receive.

AdelaFlores-Brennan is Executive Director with the Colorado Consumer Health Initiative, a nonprofit dedicated to affordable health care. The group is cautiously optimistic.

“This is a really positive signal. I don’t think we want to get ahead of ourselves, but it’s certainly something that we want to continue to watch.”

Flores Brennan says state insurance officials did a good job of tackling a thorny issue. Because of the way the state had designated rate-pricing regions in Colorado, insurance prices in the Roaring Fork Valley and other mountain areas have been much higher compared to the rest of Colorado.

“The division took steps to reach out to consumers and redo the rating areas, in some of the more expensive areas of the state, and it looks like there will be reductions in those rates.”

While insurance officials acknowledge that might be true, spokesman Vince Plymell says a more critical reason is the cost of health care. That includes, say the lease for a doctor’s office and how much medical providers get paid by insurance companies for patient visits, and more.

A big reason health insurance rates have gone down, is that insurance companies have bargained for lower payments to doctors, nurses, and other medical providers for taking care of a patient. Again, Vince Plymell.

“Two health insurance companies in particular, Anthem and the Colorado Health Insurance Cooperative, Colorado Health Op, went into those areas, especially the mountain areas, and tried to sit down at the table with providers, doctors, hospitals in those areas to talk about their contracted rates, and develop something, work towards a more affordable product.”

As of late Tuesday afternoon, Aspen Valley Hospital had not responded to a request about whether their services will be reimbursed for less by insurance companies. A spokeswoman for Valley View Hospital in Glenwood Springs says they have not accepted lower prices from insurance companies, but administrators believe they’ve done a good job making sure patients can afford care, especially heart, brain, spine and cancer treatment.

As for insurance rates, state officials tried to make it possible for residents to review rates before they were approved. But a confusing and flawed website made that impossible in some cases. Officials promise improvements next year. For now, residents are encouraged to shop around if their rates for next year go up too high.

Editor’s note: We’d love to hear about your experience with health insurance and health care in the Roaring Fork Valley area. Are you thinking about buying a new plan? Are you satisfied with your current plan and aim to keep it next year? Please email your experiences to elise@aspenpublicradio.org.